The right accounting software for small law firm operations can transform your practice from an ongoing balancing act into an efficient, successful business. Small firms face unique challenges that generic business software simply can’t address. Trust accounting requirements. Client billing complexities. Compliance with state bar regulations. These aren’t just bookkeeping tasks, they’re the foundation that determines whether your firm thrives or struggles to survive.

You don’t need enterprise-level complexity or enterprise-level pricing! What you need is specialized software that understands the unique demands of legal practice while remaining simple enough for a solo practitioner or small team to manage effectively.

Why Small Law Firms Need Specialized Accounting Software

Your law firm operates under regulations that other businesses don’t face, and your software needs to reflect these realities.

The financial management challenges facing small law firms include trust account compliance, client billing accuracy, expense tracking for multiple cases, and regulatory reporting requirements. Our guide on ‘What Makes Law Firm Finances Unique?’ covers these distinctions comprehensively, but the core issue remains: you need software designed specifically for legal practices.

There are a number of major obstacles that small legal firms face while using generic business software:

- Trust account management requires separate tracking that maintains client fund separation

- Time and billing integration must connect seamlessly with case management workflows

- Expense allocation needs to track costs across multiple clients and matters accurately

- Compliance reporting demands specific formats that meet state bar requirements

- Client cost recovery requires detailed tracking and proper billing procedures

Imagine the consequences of using inadequate software. A trust account reconciliation error can trigger a bar investigation. Missed billable hours directly impact your revenue. Poor expense tracking means you absorb costs that clients should reimburse. These are threats to your firm’s financial stability and professional standing.

The right accounting software for lawyers eliminates these risks while simplifying your daily operations. Instead of struggling with workarounds and manual processes, you gain tools designed specifically for legal practice management.

Essential Features For Law Firm Accounting Software

When evaluating accounting software law firms, there are some things that set excellent solutions apart from just average ones. Your software should handle the complexities of legal practice while remaining user-friendly enough for small firm operations.

Trust Account Management

This feature stands as the most critical requirement for any legal accounting solution. Your software must maintain strict separation between client funds and operating accounts while providing real-time balance tracking and automated reconciliation capabilities.

Key trust account features include:

- Automatic segregation of client funds from operating accounts

- Real-time balance tracking for each client trust account

- Daily reconciliation tools that simplify compliance procedures

- Audit trail creation for every trust account transaction

- Multi-client tracking within pooled trust accounts

Time and Billing Integration

Efficient billing directly impacts your firm’s profitability, and seamless integration between time tracking and billing functions saves hours of administrative work while improving accuracy.

Essential billing features include:

- Automated time capture from various sources and applications

- Customizable billing formats that match your firm’s professional standards

- Expense integration that includes client costs automatically

- Payment processing capabilities for multiple payment methods

- Outstanding invoice tracking with automated follow-up options

Financial Reporting and Analytics

Small firms need clear visibility into their financial performance without the complexity of enterprise-level reporting systems. Your software should provide actionable insights that support better business decisions.

Compliance and Security

Legal practices handle sensitive client information and must meet strict regulatory requirements. Your accounting software must provide bank-level security while maintaining compliance with professional standards.

Top Accounting Software Options For Small Law Firms

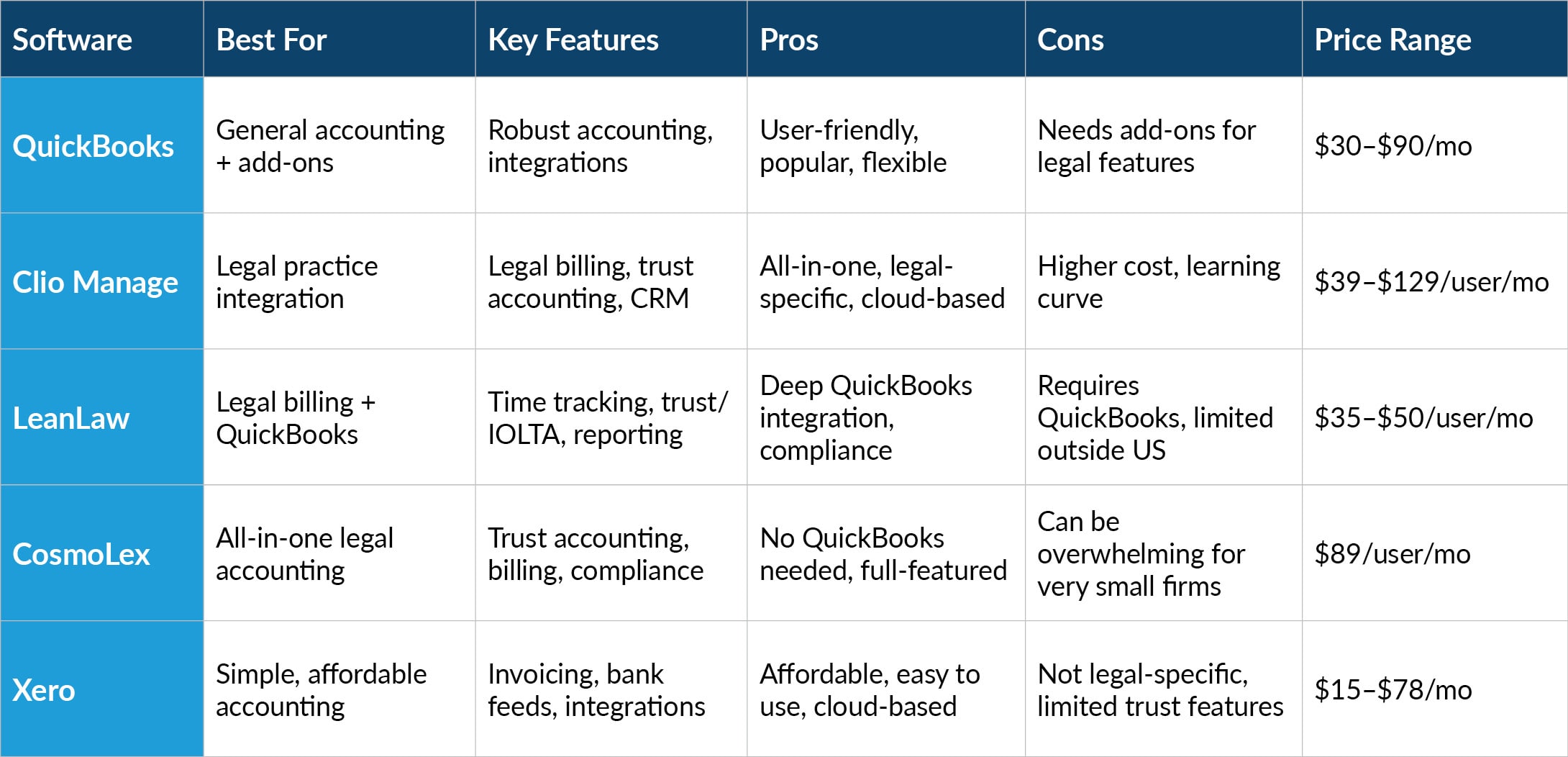

Choosing the best accounting software for small law firm operations means balancing legal-specific features, usability, and cost. Below, we compare the top platforms used by small law firms in the USA, including a summary table for quick reference and detailed breakdowns of each option.

QuickBooks Online

Why it’s a good fit:

QuickBooks is the most widely used small business accounting software in the US. For small law firms, it offers powerful core accounting features, easy bank reconciliation, and a familiar interface. With the right legal practice management integrations (such as LeanLaw or Clio), QuickBooks can handle time tracking, billing, and even trust accounting.

Pros:

- Affordable and scalable

- Extensive app marketplace for legal add-ons

- Easy to find accountants familiar with the platform

- Reliable customer support

Cons:

- Not legal-specific out of the box

- Trust accounting requires third-party integrations

- Manual setup needed for compliance

Clio Manage (with Clio Accounting)

Why it’s a good fit:

Clio is designed specifically for law firms and is a leader in legal practice management. Its accounting module (Clio Accounting) integrates billing, trust accounting, and compliance reporting directly into your workflow. Clio’s cloud-based platform is ideal for firms seeking a seamless, all-in-one solution.

Pros:

- Built for lawyers, with legal compliance in mind

- Powerful billing and trust accounting tools

- Integrates with many other legal and business platforms

- Excellent support and training resources

Cons:

- Higher monthly cost, especially as you add users

- May be more than needed for solo practitioners

- Some advanced features require higher-tier plans

LeanLaw

Why it’s a good fit:

LeanLaw is purpose-built for law firms that want deep integration with QuickBooks Online. It excels at time tracking, legal billing, and trust/IOLTA accounting, making it a favorite among small and mid-sized law firms that already use (or want to use) QuickBooks.

Pros:

- Seamless QuickBooks integration

- Designed for legal workflows and compliance

- Affordable for small firms

- Excellent trust accounting functionality

Cons:

- Requires QuickBooks subscription

- Limited international support

- Fewer practice management features than Clio or CosmoLex

CosmoLex

Why it’s a good fit:

CosmoLex is an all-in-one legal accounting and practice management solution. It includes everything a small law firm needs: trust accounting, billing, compliance, and even document management—no need for QuickBooks or other third-party accounting tools.

Pros:

- Complete legal accounting suite

- No need for separate accounting software

- Strong compliance and trust accounting features

- Cloud-based with frequent updates

Cons:

- Higher per-user cost

- Feature-rich platform may be overwhelming for very small firms

- Some users report a learning curve

Xero

Why it’s a good fit:

Xero is a user-friendly, affordable cloud accounting platform. While not legal-specific, it works well for solo and small firms that want basic accounting, invoicing, and bank reconciliation. With the right integrations, it can support legal billing and reporting needs.

Pros:

- Simple, intuitive interface

- Affordable pricing

- Good for firms with basic needs

- Integrates with practice management tools

Cons:

- Lacks built-in legal compliance features

- Trust accounting requires third-party apps

- Limited legal-specific support

How to Choose the Right Solution for Your Firm

When selecting accounting software for lawyers, consider:

- Your firm’s size and complexity: Solo practitioners may prefer QuickBooks or Xero, while growing firms benefit from Clio or CosmoLex.

- Compliance needs: If trust accounting and regulatory compliance are top priorities, choose a legal-specific platform.

- Integration with existing systems: Ensure your practice management and accounting tools can “talk” to each other.

- Support and training: Look for vendors with strong onboarding and ongoing support.

Integration With Practice Management Systems

The best accounting software for small law firm operations integrates seamlessly with your existing practice management tools, eliminating duplicate data entry while maintaining accuracy across all systems.

Modern legal software ecosystems center around integration capabilities that connect time tracking, case management, document storage, and financial management into unified workflows. Clio exemplifies this approach by offering comprehensive integration options that streamline operations across multiple software platforms.

Benefits of integrated systems:

- Reduced data entry eliminates duplicate work and human errors

- Improved accuracy through automatic synchronization between systems

- Streamlined workflows that connect client work with billing processes

- Better reporting capabilities across all aspects of your practice

- Enhanced client service through improved information accessibility

Common integration points:

- Time tracking synchronization automatically transfers billable hours to invoices

- Expense integration includes client costs in billing without manual entry

- Document management connection links case files with financial records

- Calendar integration tracks time spent in meetings and court appearances

- Communication tools record billable communications automatically

The initial setup investment for integrated systems pays dividends through improved efficiency and reduced administrative burden. Small firms often discover that integration capabilities eliminate the need for additional staff as they grow.

Expert Support During System Transitions

Switching accounting software can feel overwhelming, but you don’t have to manage it alone. When changing from one accounting platform to another, maintaining accurate financial records during the transition is crucial for compliance and business continuity.

Professional legal bookkeeping services like Cashroom specialize in helping law firms manage these transitions seamlessly. As system-agnostic experts, experienced legal bookkeepers can work with any combination of accounting and practice management software, ensuring your financial data remains accurate and compliant throughout the change process.

Key benefits of professional support during software transitions:

- Continuous compliance: Maintain trust account compliance and regulatory requirements during system changes

- Data accuracy: Ensure accurate migration of historical financial data to your new platform

- Zero downtime: Keep your financial operations running smoothly while implementing new software

- Expert setup: Proper configuration of legal-specific features and compliance tools

- Staff training support: Reduce the learning curve for your team with expert guidance

Whether you’re implementing QuickBooks with legal add-ons, migrating to Clio, or adopting any other platform, partnering with experienced legal bookkeepers makes sure your accounting remains accurate and compliant from day one.

Cost Considerations And ROI For Small Firms

Understanding the true cost of accounting software requires looking beyond monthly subscription fees to consider implementation, training, and ongoing support expenses. The right accounting software for lawyers provides positive return on investment through improved efficiency and reduced errors.

Total Cost Analysis Components

Monthly or annual subscription fees represent the most visible expense, but implementation costs, staff training time, data migration expenses, and ongoing support needs contribute significantly to total ownership costs.

ROI Calculation Factors

- Time savings from automated processes and integrated workflows

- Error reduction that prevents costly compliance issues and billing mistakes

- Improved billing efficiency that reduces collection time and increases recovery rates

- Better financial visibility that supports more profitable business decisions

- Reduced administrative overhead that allows focus on billable work

Consider a solo practitioner spending 10 hours weekly on basic bookkeeping and billing tasks. Quality accounting software might reduce this to 3 hours weekly, freeing 7 hours for billable work. At a modest billing rate of $200 per hour, this represents $1,400 in weekly opportunity value, far exceeding typical software costs.

Budget-Friendly Strategies

- Start with basic features and upgrade as your firm grows

- Take advantage of trial periods to test multiple solutions thoroughly

- Consider annual payment discounts that reduce overall costs

- Evaluate integration costs alongside base software pricing

- Factor in training time when comparing different platforms

Implementation Best Practices

Successfully implementing new accounting software requires careful planning and systematic execution to minimize disruption while maximizing benefits.

Pre-Implementation Planning

Document your current processes and identify specific pain points that new software should address. Clean up existing financial data to ensure accurate migration. Train key staff members before going live with the new system.

Migration Strategy

- Data backup creation before beginning any migration process

- Parallel operation running old and new systems simultaneously during transition

- Gradual rollout implementing features progressively rather than all at once

- Staff training conducted in small groups with hands-on practice

- Support system established for questions and troubleshooting during transition

Post-Implementation Optimization

Regular review of software utilization helps identify underused features that could improve efficiency. Staff feedback sessions reveal practical improvements and training needs. Performance monitoring ensures the software delivers expected benefits.

The most successful implementations involve the entire team from planning through execution. Staff members who participate in software selection and setup become champions who help others adapt more quickly.

Security And Compliance Considerations

Legal practices handle confidential client information that demands the highest security standards, and your accounting software must meet these requirements while maintaining operational efficiency.

Essential Security Features

Multi-factor authentication protects against unauthorized access even if passwords are compromised. Encryption of data both in transit and at rest ensures information remains confidential. Regular security audits and compliance certifications provide additional assurance.

Compliance Requirements

The IRS and state bar associations impose specific requirements on law firm financial management, and your software must support compliance rather than creating additional burden.

Key compliance considerations

- Trust account segregation that meets state bar requirements automatically

- Audit trail creation for all financial transactions and account access

- Regular backup procedures that protect against data loss and support disaster recovery

- Access controls that limit financial information to authorized personnel only

- Reporting capabilities that generate required regulatory reports accurately

Data Protection Best Practices

Regular password updates and staff training on security procedures reduce human error risks. Restricted access controls ensure only authorized team members can view sensitive financial information. Backup and disaster recovery plans protect against data loss from various scenarios.

Common Implementation Challenges And Solutions

Small law firms often face challenges when implementing new accounting software, but understanding these issues in advance helps prevent problems and accelerate successful adoption.

Staff Resistance and Training Issues

Team members comfortable with existing processes may resist change, especially if previous software transitions created problems. Address this challenge through comprehensive training and clear communication about benefits.

Effective training strategies:

- Hands-on practice sessions with realistic firm data and scenarios

- Gradual feature introduction rather than overwhelming users with complete functionality

- Champion identification among staff members who can help train others

- Ongoing support availability during the critical first weeks of operation

- Success celebration when team members master new processes and see benefits

Data Migration Complications

Historical financial data may not transfer perfectly between systems, requiring manual cleanup and verification. Plan extra time for data validation and correction during migration.

Technical Integration Problems

Connecting new accounting software with existing practice management systems sometimes reveals compatibility issues that require additional configuration or third-party tools.

Most implementation challenges resolve through patience, proper planning, and professional support from software vendors who understand legal practice requirements.

Maximizing Your Software Investment

Getting the most value from your accounting software investment requires ongoing attention to optimization, training, and feature utilization.

Regular System Review

Monthly evaluation of software utilization helps identify features that could improve efficiency but remain unused. Staff feedback reveals practical improvements and additional training needs. Performance measurement makes sure the software continues delivering expected benefits.

Continuous Improvement Opportunities:

- Feature exploration to discover new capabilities that support your growing practice

- Integration expansion as additional compatible software becomes available

- Process refinement based on actual usage patterns and staff feedback

- Training updates for new staff members and software feature additions

- Performance monitoring to ensure continued efficiency gains

Cash Flow Management Integration

Your accounting software should support comprehensive cash flow management that helps maintain financial stability while funding growth opportunities. Our guide on ‘10 Simple Ways To Manage Your Law Firm’s Cash Flow’ provides detailed strategies that work best when supported by quality financial management software.

Advanced Features to Consider

As your firm grows, advanced features like automated billing, detailed profitability analysis, multi-location support, and enhanced reporting capabilities become more valuable and may justify upgrading to more sophisticated platforms.

Future-Proofing Your Accounting System

Choosing accounting software that can grow with your practice prevents the need for disruptive transitions as your firm evolves and expands.

Scalability Considerations

Your software should handle increasing transaction volumes, additional staff members, multiple office locations, and expanding practice areas without requiring complete system replacement.

Technology Evolution

The legal industry continues adopting new technologies that improve efficiency and client service. Your accounting software should integrate with emerging tools rather than creating barriers to innovation.

Professional Growth Support

As your practice becomes more sophisticated, your accounting needs will evolve beyond basic bookkeeping to include advanced analytics, strategic planning support, and complex financial reporting.

The best accounting software for small law firm operations today should provide a foundation for the successful practice you’re building for tomorrow. Quality accounting software represents an investment in your firm’s future rather than simply a current operational expense.

Making Your Final Decision

Choosing the right accounting software requires balancing current needs with future growth plans while considering budget constraints and staff capabilities.

Decision Framework

Create a comparison matrix that evaluates each option against your specific requirements. Weight factors according to their importance to your practice. Include total cost of ownership rather than just monthly fees.

Trial Period Utilization

Most quality software providers offer trial periods that allow hands-on evaluation with your actual firm data. Use these opportunities to test critical features and assess user-friendliness.

Professional Consultation

Consider consulting with other small law firms that use different software solutions. Their real-world experiences provide valuable insights beyond marketing materials and software demonstrations.

The right accounting software transforms your small law firm’s financial management from a time-consuming burden into a competitive advantage that supports growth and profitability.

Ready to streamline your firm’s financial management and focus on practicing law? Contact us today to schedule a consultation and discover how specialized accounting solutions can support your small law firm’s success and growth.

FAQs

What's the most important feature in accounting software for small law firms?

Trust account management tops the list, as proper client fund separation is legally required and mistakes can result in serious professional consequences.

Can I use regular business accounting software for my law firm?

While possible, general business software lacks legal-specific features like trust accounting and may require workarounds that increase compliance risks.

Do I need separate billing and accounting software?

Integrated solutions usually provide better value and efficiency, but some firms prefer specialized billing software with basic accounting integration.

How long does it take to implement new accounting software?

Most small firms complete implementation within 2-4 weeks, including data migration, staff training, and system testing.

What security features should I prioritize?

Multi-factor authentication, data encryption, regular backups, and compliance certifications are essential for protecting confidential client information.

Can accounting software help with trust account compliance?

Yes, legal-specific software typically includes automatic trust account segregation, daily reconciliation tools, and audit trail creation for compliance support.

Should I choose cloud-based or desktop accounting software?

Cloud-based solutions generally offer better security, automatic updates, and remote access capabilities that benefit most small law firms.

How do I train my staff on new accounting software?

Start with hands-on training sessions using real firm data, introduce features gradually, and maintain ongoing support during the transition period.